Colorado Unemployment 1099-G Forms: Find Info & FAQs | Now

Are you navigating the complexities of unemployment benefits and tax season? Understanding the nuances of the 1099-G form is critical to accurately filing your taxes and avoiding potential penalties.

The 1099-G form, in essence, is a financial snapshot provided by the government detailing the unemployment benefits you received during the previous tax year. It's a crucial document that informs you of the total amount of unemployment compensation, and importantly, any federal income tax that was withheld from those benefits, should you have opted for that. Failing to understand and accurately report this information can lead to significant errors on your tax return, potentially resulting in underpayment of taxes and subsequent penalties. The form is more than just a summary; it's a necessary component for your federal tax return, because, as per the Internal Revenue Service (IRS), unemployment benefits are considered taxable income. This means that the amount of benefits you received, whether they be from a state program or, in some cases, a federal program, must be included when calculating your gross income.

For those residing in the state of Colorado, the Colorado Department of Labor & Employment (CDLE) is the primary authority responsible for the distribution of these forms. If you're seeking the Employer Identification Number (EIN) and address for the state of Colorado for tax purposes, you'll likely find this information associated with the CDLE. The process of obtaining and understanding your 1099-G is usually straightforward. You can often access your tax forms online if you have an online account where you manage your unemployment benefits. This online portal allows you to view and download your 1099-G form, offering a convenient and paperless solution for accessing crucial tax information. Remember to select the relevant tax year to view the document.

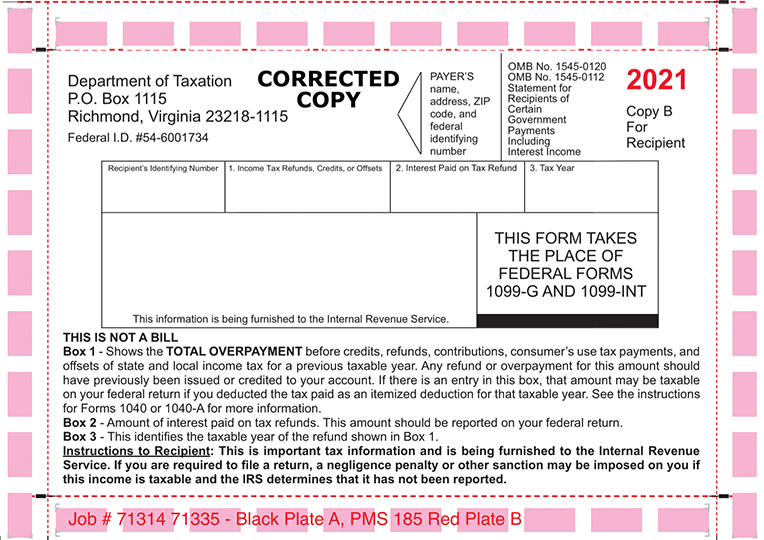

If, for any reason, your 1099-G form contains errors or requires correction, the labor department will issue a corrected form. This corrected form will be clearly marked with a checkmark on the top, signifying that it is the updated version. In cases where the unemployment compensation amount is incorrect, the corrected form will often reflect a $0 amount in the unemployment compensation box, should the need arise.

It's also important to be aware of the potential for fraudulent claims. The government, including entities like the CDLE, takes the prevention of fraudulent unemployment claims very seriously. If you suspect that you are the victim of identity theft or that someone has fraudulently filed for unemployment benefits using your information, it is crucial to report it immediately. Reporting suspected fraudulent claims to CDLE fraud prevention is a critical step in protecting yourself and preventing further misuse of your personal information.

The Colorado unemployment system, like any government system, undergoes periods of scheduled maintenance. Occasionally, the system may be temporarily unavailable. In many instances, these downtimes are scheduled to occur during off-peak hours, such as between 10:00 PM and 3:00 AM Mountain Time, to minimize any disruption to users. During these times, you may experience temporary access issues.

Navigating unemployment benefits and tax preparation can sometimes seem daunting. However, armed with the correct information, and by paying attention to detail, you can navigate these processes smoothly. Consider the resources provided by the CDLE and IRS, to ensure youre well-prepared for tax season.

| Key Aspects of the 1099-G Form in Colorado | |

|---|---|

| Purpose | Reports the amount of unemployment benefits received during the tax year and any federal income tax withheld. It's essential for accurately filing your federal tax return. |

| Taxability | Unemployment benefits are considered taxable income by the IRS. |

| Issuing Authority in Colorado | The Colorado Department of Labor & Employment (CDLE) is responsible for issuing the 1099-G forms. |

| Accessing the Form | Often accessible online through your account where you manage your unemployment benefits. Select the relevant tax year to view and download the document. |

| Corrections | Corrected forms are sent if there are errors. These forms are marked with a checkmark and may show a $0 amount in the "unemployment compensation" box if necessary. |

| Fraud Prevention | Crucial to report suspected fraudulent claims to CDLE fraud prevention. |

| System Availability | The Colorado unemployment system might be unavailable during scheduled maintenance, typically between 10:00 PM and 3:00 AM (Mountain Time). |

| Relevant Links |

|

When it comes to preparing your tax return, it is wise to approach it with the understanding that the 1099-G form is a crucial component. If, for example, you're uncertain about the taxability of certain payments, consult with a tax professional or refer to the IRS guidelines. Similarly, if you encounter errors while preparing your return, be sure to clarify the situation with the CDLE to obtain a corrected form or other necessary information. By approaching the situation with due diligence and an awareness of the pertinent information, you can confidently manage the process of reporting your unemployment benefits on your tax return.

In conclusion, the 1099-G form is a vital document for accurately reporting your unemployment benefits to the IRS. It is your record of the money you received and any federal income taxes that were withheld. Understanding the form, its purpose, and how to access and correct it is essential. By staying informed, taking appropriate measures to report any suspected fraudulent claims, and leveraging available resources, you can navigate the process of reporting unemployment benefits and remain compliant.

For those who may be wondering, filing your state income taxes can usually be done online, further simplifying the process. The digital accessibility of these services underscores the emphasis on convenience and efficiency within today's administrative systems. Remember, staying informed and taking proactive steps to manage your benefits is the best way to deal with the challenges of the tax season.