Colorado Payroll & UI Taxes 2025: What You Need To Know

Are you prepared for the financial landscape of 2025 in Colorado? Navigating the complexities of payroll and unemployment taxes is crucial for both employers and employees, and staying informed can save you time and money.

The state of Colorado, like many others, continuously refines its tax regulations to adapt to the evolving economic climate and ensure the effective functioning of its social safety nets. Understanding these changes is not merely a matter of compliance; its a strategic advantage.

Let's delve into the specifics, providing a comprehensive look at the key components of Colorado's payroll and unemployment taxes, helping you stay ahead of the curve. This includes an in-depth exploration of State Unemployment Insurance (SUI), wage withholding taxes, and Occupational Privilege Taxes (OPT), among other crucial aspects.

The bedrock of Colorado's unemployment benefits system was established in 1935 under the Social Security Act. Since then, the state has been adapting its unemployment insurance program (SUI) to meet the needs of its workforce and economy. The system is designed to provide temporary financial assistance to those who have lost their jobs through no fault of their own, ensuring that individuals and families have a financial cushion during a difficult period.

For those collecting unemployment compensation, it's vital to remember that the state considers it taxable income. There is no need to be concerned about which tax bracket you fall into, as Colorado applies a flat income tax rate of 4.4% on your unemployment benefits. While this simplifies the process, it highlights the importance of considering the tax implications of receiving unemployment compensation.

For 2025, the minimum wage in Colorado is set at $14.81 per hour, with a rate of $11.79 per hour for tipped employees. This is a crucial piece of information, as it directly impacts payroll calculations and budgeting for businesses across the state. This directly impacts the cost of doing business in Colorado, and employers need to take this into account when planning.

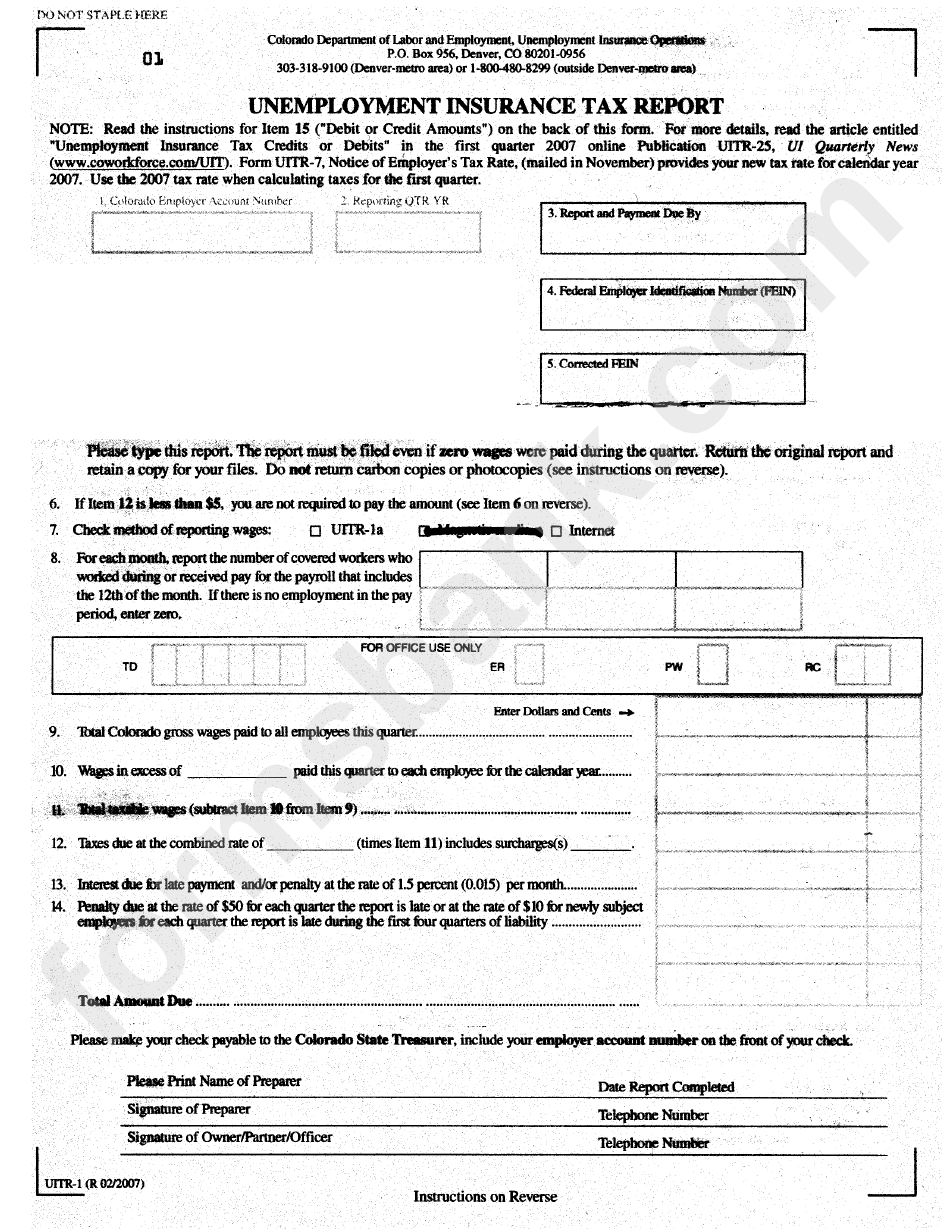

When it comes to payroll taxes, Colorado employers must understand their obligations and how to meet them accurately. The Colorado Department of Labor and Employment (CDLE) oversees the collection and administration of these taxes. The calculation of these taxes, as well as the maximum contributions, is something employers have to get familiar with to ensure that compliance is maintained.

One of the crucial payroll taxes is the State Unemployment Insurance (SUI). Colorados system has been in place since 1935. This tax funds unemployment benefits for eligible workers who lose their jobs. Employers are required to pay SUI premiums, and the rates vary depending on the employers experience rating, which is determined by the stability of their workforce and the number of unemployment claims filed by former employees.

For 2025, the unemployment insurance tax range is from 0.81% to 12.34%. New employers typically start at a rate of 3.05%. These rates are applied to the first $27,200 of wages paid to each employee. Its crucial for employers to understand these rates because they directly affect labor costs and operational expenses.

Beyond SUI, businesses in Colorado must also be familiar with the Wage Withholding Tax. This is the amount withheld from an employees paycheck to cover their state income tax liability. The state income tax rate is 4.4% and is levied on an individuals taxable income.

Occupational Privilege Taxes (OPT) also play a role in the payroll tax landscape in some localities. OPTs are local taxes levied on the privilege of working within a specific city or county. They are typically paid by both employers and employees. It is worth noting that religious and charitable organizations may be exempt from the employer (business) portion of the occupational privilege tax.

Employers should also be aware of the Federal Unemployment Tax Act (FUTA). While employers are required to pay SUI premiums, they may still be exempt from federal unemployment premiums under FUTA 3306 (c)(8). However, those who acquire all of a Colorado trade, business, or organization, or a substantial portion of the assets from a predecessor employer who is liable to pay unemployment insurance premiums, are subject to FUTA.

Employers must pay UI premiums if they meet one or both of the following requirements: they paid wages of at least $1,500 in a calendar quarter during the current or previous calendar year.

Employees may also have a role to play in the withholding process. While claiming exempt for federal withholding is an option, employees can still request Colorado withholding by entering the amount per pay period on Form DR 0004 line 3.

The state also offers resources for both employers and employees. The Division of Unemployment Insurance Customer Service has a physical location in Denver, CO, at 621 17th Street, Suite 100, 80202. Here, individuals can get help and assistance with their unemployment insurance claims.

Additionally, individuals collecting unemployment benefits must register with their local workforce center prior to collecting benefits. This is a crucial step in understanding their responsibilities and accessing necessary resources.

Taxpayers who received unemployment compensation in 2020 may be eligible to amend their tax returns. As a result, eligible taxpayers who did not previously exclude up to $10,200 of unemployment compensation from the federal taxable income reported to Colorado, or who added back the excluded amount of unemployment compensation, may amend their 2020 income tax return to claim the exclusion.

The instructions for amending tax returns depend on the specific circumstances of each 2020 filing. The primary goal is to inform both the taxpayer and the IRS about all income received that may be taxable.

Taxpayers are advised to carefully review their federal and state income tax filings for the 2020 tax year to determine whether they qualified for the exclusion. Questions about taxes on UI payments should be directed to the Internal Revenue Service (IRS) or a tax professional.

Federal employees who have been recently laid off may be eligible for unemployment benefits. It's important for them to understand the eligibility requirements and how to file a claim.

Unemployment benefit payments are funded by the premiums paid by Colorado employers into the UI trust fund. This underscores the critical role of employers in supporting the states unemployment system.

When it comes to unemployment compensation, individuals have options. You can choose to have taxes automatically deducted from payments or pay taxes later. However, you are allowed to change from one option to the other only once during your unemployment claim. Make sure to choose the option that suits your financial needs.

You should receive Form 1099-G from the Colorado Department of Labor and Employment. This form shows the amount of benefits you were paid during the previous year and the amount of income tax withheld, if you selected that option.

The state of Colorado has also been making adjustments to its unemployment system. Legislation, such as House Bill 232, has been enacted with the goal of improving the unemployment system. It's vital to stay up to date with any changes or updates.

Staying informed about the intricate details of Colorado's payroll and unemployment taxes is important for both employees and employers. Proper understanding of the regulations allows companies to avoid penalties and accurately fulfill their obligations. For individuals, awareness is essential to access available financial assistance and meet tax responsibilities.

| Topic | Details | Additional Information | Source |

|---|---|---|---|

| Minimum Wage 2025 | $14.81/hour | $11.79/hour for tipped employees | Colorado Department of Labor and Employment |

| State Income Tax Rate | 4.4% | Flat rate on taxable income | Colorado Department of Revenue |

| Unemployment Insurance (SUI) Tax | Range: 0.81% to 12.34% (2025) | New employer rate: 3.05% on first $27,200 of wages | Colorado Unemployment |

| Federal Unemployment Tax (FUTA) | 0% | Internal Revenue Service (IRS) | |

| Wage Withholding Tax | Withheld from employee paychecks | Covers state income tax liability | Colorado Department of Revenue |

| Occupational Privilege Tax (OPT) | Local taxes | Paid by employers and employees | Local Government websites |

By staying informed, businesses can make informed decisions that comply with the law and support their financial health, employees can ensure that they are receiving their rightful benefits and meeting their financial responsibilities. Whether you are an employer or employee, understanding the complexities of Colorado's payroll and unemployment taxes is essential for navigating the financial landscape of 2025.