Colorado 1099 Filing: Key Dates & DR 1106 Insights - Important!

Are you grappling with the intricacies of Colorado state taxes and the associated forms? Understanding the specific requirements for filing 1099s, income tax returns, and managing your tax account can seem daunting, but it doesn't have to be. This article provides a clear, concise guide to help you navigate the Colorado Department of Revenue regulations with confidence.

Navigating the complex landscape of state tax requirements, particularly in a state like Colorado, demands a keen understanding of various forms, deadlines, and regulations. This guide offers a comprehensive overview of essential tax-related procedures, ensuring individuals and businesses remain compliant with the Colorado Department of Revenue. Whether you are an employer filing 1099s, an individual submitting an income tax return, or simply seeking to understand your tax obligations, this article aims to provide clarity and direction.

Let's begin by addressing the core issue: Colorado's requirements for 1099 forms. The state mandates that all 1099 forms be filed with the Colorado Department of Revenue. This means that if you're a payer of income that requires federal form 1099, you also have a state-level obligation. The annual transmittal of state 1099s, using the DR 1106 form, should be submitted in January, coinciding with the reporting of withholding taxes from the federal 1099 forms.

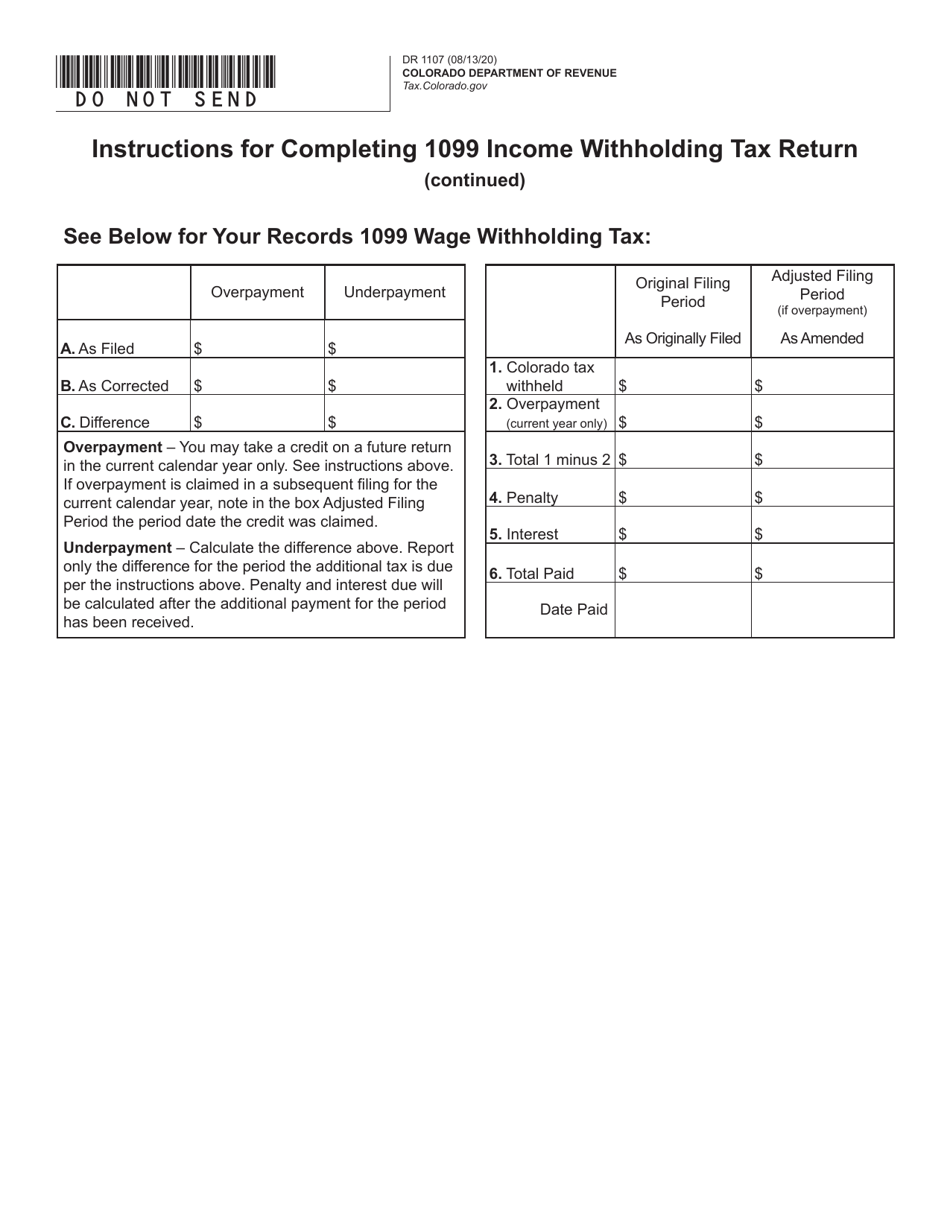

One critical aspect of ensuring compliance is the accurate and timely filing of these forms. For those filing paper 1099 statements, the annual reconciliation statement (DR 1106) must be enclosed. If you're filing 250 or more 1099 forms, electronic filing is mandatory, streamlining the process and reducing potential errors. The DR 1107 income withholding tax return should only be filed for current year 1099 withholding.

When it comes to income tax returns, whether you're submitting documentation electronically, applying for a PTC rebate, or simply filing your individual income tax return, you'll find that the state offers multiple avenues for compliance. If you need to amend your return, you must explicitly mark the "amended return" box. Moreover, amended returns demand the inclusion of all tax columns with corrected information, not just the differences.

Several resources are available for managing your tax account, including Revenue Online. This platform is designed to help you understand and fulfill your tax obligations more efficiently. You can find valuable information regarding each tax type and how to settle your tax liability on the Department of Revenue's official website. This includes specific details on different methods for paying your tax liability.

The Colorado Department of Revenue offers numerous resources and incentives. For instance, families saving for college, currently paying for college, or repaying student loans may qualify for tax incentives. It is also crucial to recognize that, generally speaking, the role of an employer means less direct responsibility for an employee concerning tax form submission. In contrast, independent contractors might find themselves handling the documentation of their earnings.

Finally, be aware that the "amount showing in box 1" on your Colorado individual income tax return (such as the 2023 form) might be overstated. For specific year-related forms, only the most recent version is published on the official website. If you need a prior year form, you can contact the department directly via email at dor_taxpayerservice@state.co.us.

Navigating Colorado's Tax Forms: A Quick Reference

Understanding Colorado tax requirements can seem complex. Below is a table that summarizes key forms and their uses to help you navigate your responsibilities effectively.

| Form | Description | Purpose | Filing Deadline | Notes |

|---|---|---|---|---|

| DR 1106 | Annual Transmittal of State 1099s | To report and reconcile state 1099 information with the Colorado Department of Revenue. | January | Must be filed with paper 1099 statements. Electronic filing required if 250 or more forms are filed. |

| DR 1107 | Income Withholding Tax Return | To report and remit income tax withheld from employees. | Varies depending on filing frequency (monthly, quarterly, etc.) | To be filed for current year 1099 withholding only. |

| 1099 Forms | Various types (e.g., 1099-NEC, 1099-MISC) | To report various types of income payments to non-employees. | Typically, by January 31st (check the specific form instructions) | Colorado requires the state copy to be filed. |

| Individual Income Tax Return | Colorado State Income Tax Return | To report your income and calculate your state income tax liability. | April 15th (typically) | Can be filed online or by mail; documentation can be submitted electronically. |

| Amended Return | Corrected Colorado State Income Tax Return | To correct errors or omissions on a previously filed return. | Follow the original filing deadline or within the statute of limitations (typically 3 years from filing). | Must mark the "amended return" box and correct all tax columns. |

Understanding the Colorado Department of Revenues Filing Requirements

Colorado's tax laws are designed to ensure the state receives the revenue necessary to fund public services while also offering incentives and support to its residents. Meeting these requirements requires accurate reporting, adherence to deadlines, and a clear understanding of your obligations.

1099 Forms: Your Filing Obligations

When it comes to filing 1099 forms, Colorado mirrors federal requirements. If you are required to file 1099s federally, you are also required to file a state copy with the Colorado Department of Revenue. This encompasses various types of 1099 forms, such as 1099-NEC (for nonemployee compensation) and 1099-MISC (for miscellaneous income). You must file these forms and include the annual reconciliation statement (DR 1106) if you're submitting paper forms. Electronic filing is a mandate if you file 250 or more 1099s, which streamlines the process.

Income Tax Returns: Individual Filings

For individuals, filing state income taxes is another crucial aspect of tax compliance. You can fulfill this requirement by filing your individual income tax return, which includes the option to submit documentation electronically. In addition, Colorado offers various incentives and programs, like the PTC rebate, which individuals can apply for. Always ensure that you're using the most recent version of the form for your filings.

Paying Your Taxes: Ensuring Compliance

Each tax type has its specific requirements regarding how you can pay your tax liability. You can learn more about these specific requirements on the official website of the Colorado Department of Revenue or through Revenue Online. Ensure you understand the permissible payment methods to comply with the state's regulations.

Amended Returns: Correcting Errors

Mistakes happen. If you need to correct your tax return, you must file an amended return. Make sure to mark the "amended return" box on the form and correct all tax columns, rather than just the difference. This ensures a complete and accurate record of your tax obligations.

Managing Your Tax Account: Revenue Online

Revenue Online is a valuable resource for managing your tax account. You can use this portal to understand your tax obligations, check your payment status, and ensure you are meeting all deadlines. Familiarizing yourself with this tool can significantly streamline your tax-related processes.

Additional Information

Keep in mind that there are no fees for opening a withholding account. However, it is important to comply with filing guidelines to ensure compliance and avoid penalties. Consider reviewing the filing requirements for forms DR 1106 and DR 1101.

Disclaimer

This information is intended for informational purposes only and does not constitute legal or tax advice. Consult with a qualified tax professional for personalized advice based on your specific circumstances.