Chase Help & Info: Your Guide To Statements & More!

Are you seeking streamlined control over your finances and a clearer understanding of your mortgage? Accessing your financial data and managing your accounts securely has never been easier, offering a comprehensive suite of tools at your fingertips.

Chase Online provides a centralized hub for managing your Chase accounts. You can view statements, monitor account activity, pay bills, and securely transfer funds. For those seeking further insights, the Banking Education Center offers a wealth of information.

However, navigating the complexities of mortgages and financial instruments can be daunting. Understanding the nuances of statements, insurance, and escrow is crucial for informed decision-making. Let's break down these key areas for a clearer financial future.

| Category | Details |

|---|---|

| Chase Online Functionality |

|

| Mortgage Management Tools |

|

| Customer Support |

|

| Financial Products and Services |

|

To learn more about the grant, you can visit the official Chase website to explore properties that qualify for their homebuyer grant, which can provide $2,500 or $5,000 in select areas. The grant can lower your interest rate, cover fees, or be applied to your down payment, and it doesn't need to be repaid.

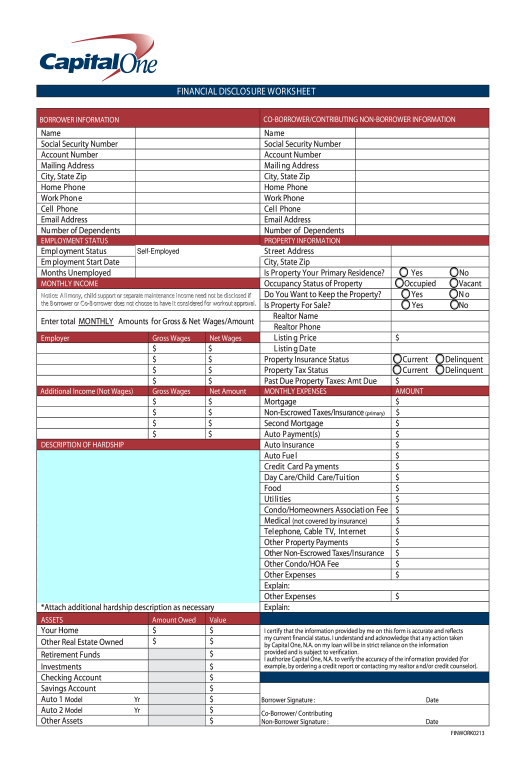

Navigating the world of mortgages requires a grasp of essential documents and terms. Your mortgage statement is a pivotal document detailing your loan's specifics. It includes vital details such as payment amounts, principal, interest, and escrow information. An annual mortgage statement offers a yearly overview, providing a comprehensive summary of your loan activity.

The mortgage statement is a document that includes key details about your loan, from the amount paid toward the principal to the escrow. Moreover, understanding how escrow operates is crucial. Your loan holder, such as Chase, utilizes this account to handle necessary payments, including homeowners insurance and property taxes.

Accessing your tax documents is essential during tax season. Tax Form 1098 reports the interest paid on mortgage and home equity accounts. For those with FHA loans originated between August 2, 1985, and January 21, 2015, specific guidelines apply to payoff funds.

If you have a mortgage with Chase, you can update your address by selecting Profile & Settings on Chase.com. Should you have questions or concerns, customer service is available to provide assistance or receive your feedback.

Consider the various options available for managing your mortgage effectively. You can apply for a mortgage or refinance it with Chase, viewing current rates or calculating what you can afford using their mortgage calculator. For further insights, visit their education center for valuable homebuying tips.

Chase offers various resources to manage your accounts, see statements, pay bills, and keep an eye on neighborhood trends. Apply for auto financing for a new or used car with Chase to get the right car.

Remember that the loan's principal balance as of January 1, 2024, or the date Chase acquired or originated the loan in 2024, is displayed in Box 2 on IRS Form 1098. The impact on your tax statements will be reflected, with each statement showing your taxes and mortgage interest paid during the period the loan provider serviced your loan.

For those looking to understand their mortgage, Chase MyHome makes it easy to find your loan balance, home values, equity, escrow, and other important details in one easy-to-use dashboard. No complicated paperwork to manage or a wide array of information to juggle; you can sign in today to see how streamlined mortgage management can be.

If you need help, you can contact Chase customer service for questions or concerns, or let them know about chase complaints and feedback. Youll receive a statement from your annual mortgage statement, which is a yearly statement that includes key details about your mortgage loan.

Chase provides affordable lending options, including FHA and VA loans, to help make homeownership possible. They also provide an affordability calculator and help you look for homebuyer grants in your area. Chase myhome is there for you, from applying for a loan to managing your mortgage.

To get started, you can choose the year and account and click the open or save icon to the right of each statement. For help in the Chase Mobile app, click on the profile & settings icon in the top right corner, select statements & documents within document manager, click on statements, select your account, and then the year and statement to open as a PDF.

Chase will not provide tax advice. Consult with your tax advisor about the deductibility of interest.

The servicing of your mortgage loan is transferring from Chase to another mortgage servicer, youll see your new payment amount on your monthly statements. You can also pay off the outstanding balance at any time. Refinance your outstanding balance into a new home equity account or new mortgage.

If you meet current credit criteria, you could refinance your outstanding balance into a new home equity line of credit or mortgage loan. The remaining shortage balance will be spread out over 12 months and added to your monthly mortgage payment.

During the month after your annual escrow analysis is complete, you can go to your Chase.com escrow summary page and use the convenient calculator to see what effect a partial payment will have on your next years mortgage payment.

For further assistance, consider these contact options:

- Find additional ways to contact us here.

- For questions or concerns, please contact Chase customer service or let us know about chase complaints and feedback.

Chase provides several options for managing your finances and staying informed about your mortgage.