Chase Mortgages: Your Guide To Homeownership & More | Chase

Are you a homeowner seeking streamlined mortgage solutions and convenient financial management? Chase provides a robust suite of tools and services, designed to simplify your mortgage journey and empower you to take control of your finances.

Chase understands that managing a mortgage can be complex. They offer various convenient and easy mortgage payment options, accessible online, allowing homeowners to pay their mortgages with ease. Beyond payments, Chase provides tools to help you navigate the entire homeownership lifecycle.

For those looking to purchase a home, the Chase Homebuyer Grant offers a significant advantage. Eligible homebuyers in select areas across the country can potentially save $2,500 or $5,000 towards their new home at closing. This grant, available for primary residence purchases, can be a substantial boost towards homeownership, particularly when utilizing Dreamaker, standard agency, FHA, and VA home purchase mortgage loan products, provided applicable census tract requirements are met.

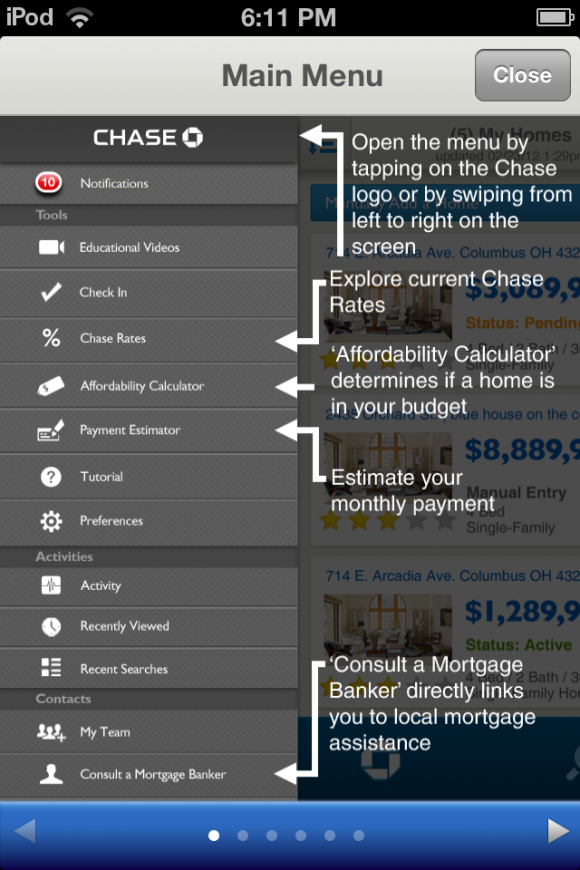

Digital convenience is a hallmark of the Chase experience. Chase Online serves as a central hub for managing your Chase accounts. From viewing statements and monitoring account activity to securely paying bills and transferring funds, Chase Online provides a streamlined and secure platform for managing your finances from one central place. Moreover, the platforms capabilities extend beyond mere transaction management; it offers home insights, access to rates, property information, and grant details.

To aid in the homebuying process, Chase offers robust online tools and resources. These resources help prospective buyers find, afford, and purchase a home. Prospective buyers can compare rates, explore loan options, apply online, and gain guidance from Chase experts. Whether you're determining affordability, estimating monthly payments with the mortgage calculator, or seeking mortgage preapproval, Chase is committed to providing support throughout the homebuying process.

A key feature of the Chase ecosystem is "Chase MyHome," a digital platform supporting homeowners at every stage, from loan applications to managing mortgage and equity. "Chase MyHome" provides a comprehensive approach, empowering users to make informed decisions about their properties.

For existing homeowners, refinancing options are readily available. Refinancing can help lower monthly payments, pay off a loan sooner, or unlock cash for large purchases, offering flexibility based on individual financial goals.

Chase also provides tools for property valuation. The Home Value Estimator can help you determine the current value of your home. By entering an address, the estimator taps into a vast database of home records to provide an estimated value. This information is crucial for homeowners, particularly when considering a sale or evaluating equity.

Understanding market dynamics is important, and Chase provides insights into the real estate landscape. When there are fewer buyers than available homes for sale, its considered a buyers market, which can potentially drive down the value of your home. Conversely, when there are fewer homes for sale, it can create a seller's market, potentially increasing the value of the home. Other homes in the neighborhood can also influence the value of your home.

Chase offers a wide range of financial products and services, including checking and savings accounts, credit cards, home loans, auto financing, and investments by J.P. Morgan. This broad suite of products demonstrates Chase's commitment to meeting diverse financial needs.

For any questions or concerns, Chase Customer Service is readily available to provide assistance. Also, the Banking Education Center is available to offer more information and guidance.

Regarding the sale of a home with a mortgage, the process is relatively straightforward. The homeowner works with their real estate agent to sell their home. If the buyer pays more for the home than the balance remaining on the mortgage and other liens, the seller will receive the net proceeds after closing costs and commissions are paid.

Homeowners can explore the available options to manage their accounts online, get mortgage calculators, access educational resources, and connect with customer service. Chase offers a range of mortgages for buying or refinancing a home, as well as home equity loans. In this way, homeowners are granted an opportunity to take control of their finances.

When it comes to securing a mortgage, consider staging your home to enhance its appeal. By presenting your home in the best possible light, you can attract prospective homebuyers. Staging can also affect the overall experience of the sale and may potentially speed up the process.

It's essential to protect personal information and follow guidelines provided for the use of the online platform. Unauthorized entry into J.P. Morgan's systems, misuse of passwords, or misuse of any information posted to a site is strictly prohibited. It is always important to remember the security precautions provided by the service providers.

Chase Premier Plus Checking offers no monthly service fee when certain conditions are met during each statement period. Maintaining an average beginning day balance of $15,000 or more, in any combination of eligible accounts, is one way to avoid this fee.

Remember, refinancing can be a powerful tool. It can help you to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Always consult with a financial advisor to determine the best options for your specific situation.

To ensure a secure experience, protect your account by signing in using your desktop password. Furthermore, if you are a Chase mortgage customer, make use of the exclusive tool available to help you stay informed.

This information is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any financial decisions.

In terms of insurance, homeowners should be aware that insurance bought through the lender can be more expensive than insurance that you can buy on your own, and that it only covers the structure of your home, not the contents. You'll be charged the cost of the insurance the lender buys. Make sure to weigh your insurance options carefully.

| Category | Details |

|---|---|

| Mortgage Payment Options | Online payments, convenient and easy access. |

| Homebuyer Grant | $2,500 or $5,000 towards closing costs in select areas for eligible buyers. |

| Online Account Management | Manage accounts, view statements, monitor activity, pay bills, transfer funds securely. |

| Chase MyHome | Digital platform for homeownership, from loan application to mortgage management. |

| Refinancing Options | Lower monthly payments, pay off the loan sooner, or access cash. |

| Home Value Estimator | Estimate the current value of your home. |

| Financial Products | Checking, savings, credit cards, home loans, auto financing, investing. |

| Customer Support | Customer service and the Banking Education Center. |

For an extensive understanding of mortgage products and services, be sure to explore the resources available through Chase. Whether you're a first-time buyer or a seasoned homeowner, Chase offers guidance at every step. Chase is dedicated to providing tools and resources to help you find, afford, and buy a home.

In conclusion, Chase provides an all-encompassing solution for homeowners and potential homebuyers. The offerings range from convenient mortgage payment options, and homebuyer grants, to robust online tools for account management and property valuation. By utilizing these resources, customers are empowered to confidently navigate the journey of homeownership.